Small Business Owners & the Corporate Transparency Act

Starting in 2024, small businesses are required to report ownership and control information to the federal government under the Corporate Transparency Act.

If your business makes less than $5 million a year or has 20 or fewer employees, it is considered a small business under this law. Any changes in ownership or control must be reported to the Financial Crimes Enforcement Network (FinCEN).

This includes updates when owners move, new DBAs are created, or subsidiaries are formed. Failure to comply with the CTA can result in significant fines or criminal charges. The CTA mandates small businesses to file Beneficial Ownership Information (BOI) Reports with FinCEN starting in 2024. It is important to understand and adhere to these regulations to avoid penalties.

Get Started Free Now – Only pay once the report has been reviewed by an expert, has your final approval and is ready to submit. Our services are only $75 for the first filing and $50 for each additional entity with similar primary ownership.

Who has to file Beneficial Ownership Information (BOI) Reports?

The CTA requires businesses formed in the United States or foreign businesses registered to do business in the United States to file BOI Reports with FinCEN. These businesses are called Reporting Companies.

Reporting Companies

The CTA requires a Reporting Company to file a BOI Report with FinCEN. A Reporting Company is a corporation, limited liability company, or other similar entity that is created by the filing of a document with a secretary of state.1 Reporting companies include businesses formed in countries other than the United States, but registered to do business in the U.S.

Based on this definition, you would be forgiven if you thought the Corporate Transparency Act applied to nearly all businesses. That is not correct.

Exemptions

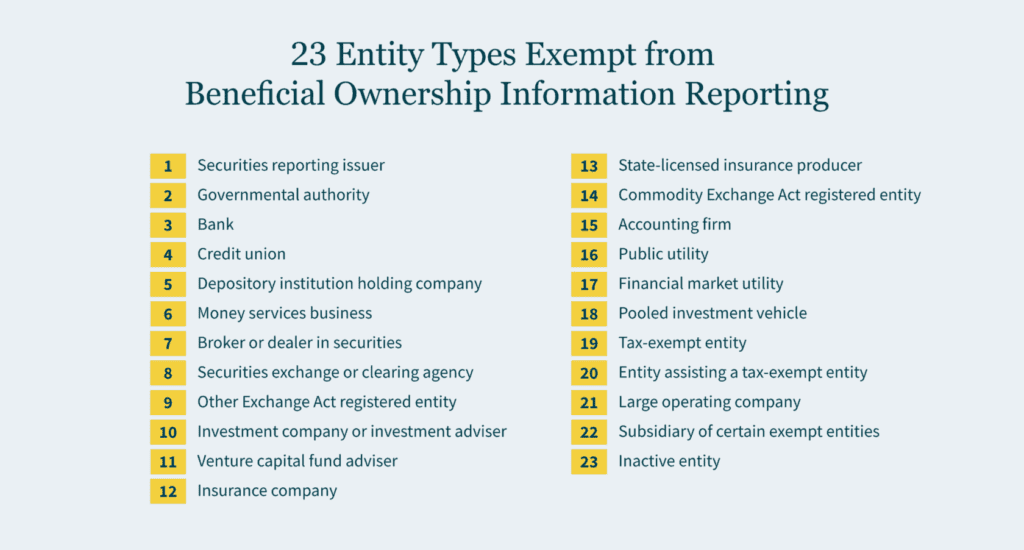

There are 23 exemptions that allow business to avoid being classified as “Reporting Company.” As a practical matter, one exemption is critical for small businesses.

The following businesses are not Reporting Companies and do not have to file a BOI Report with FinCEN:

| No. | Exemption Title |

|---|---|

| 1 | Securities reporting issuer |

| 2 | Governmental authority |

| 3 | Bank |

| 4 | Credit union |

| 5 | Depository institution holding company |

| 6 | Money services business |

| 7 | Broker or dealer in securities |

| 8 | Securities exchange or clearing agency |

| 9 | Other Exchange Act registered entity |

| 10 | Investment company or investment adviser |

| 11 | Venture capital fund adviser |

| 12 | Insurance company |

| 13 | State-licensed insurance producer |

| 14 | Commodity Exchange Act registered entity |

| 15 | Accounting firm |

| 16 | Public utility |

| 17 | Financial market utility |

| 18 | Pooled investment vehicle |

| 19 | Tax-exempt entity |

| 20 | Entity assisting a tax-exempt entity |

| 21 | Large operating company |

| 22 | Subsidiary of certain exempt entities |

| 23 | Inactive entity |

Exemptions 1 through 18 apply to businesses that are already regulated by the federal government.

Exemption 19 applies to tax-exempt entities, such as 501(c)(3) organizations, which do not have owners in the traditional sense of for-profit businesses. Exemption 20 relates to the non-profit exemption #19.

Exemption 23 applies to legal entities that are inactive, meaning that they are not engaged in any business activity.

That leaves Exemption 21 and Exemption 22. Exemption 21 applies to a business that has more than 20 employees and more than $5 million in gross receipts or sales. These are called “Large Operating Companies” in the CTA. Exemption 22 applies to a business that is owned by a Large Operating Company. These are called “Subsidiaries of Certain Exempt Entities” in the CTA.

The net effect of the reporting requirement and the exemptions is that small businesses must file Beneficial Ownership Information (BOI) Reports with FinCEN, but large companies do not. A small business under the Corporate Transparency Act (CTA) is any business that has less than $5 million in sales or employs 20 or fewer employees.

How many businesses are affected by the CTA? There is no precise number but the scale is large:2

The Small Business Administration (SBA) estimates that there are 5.4 million businesses with 1-19 employees.3 These business are all Reporting Companies under the CTA. This SBA estimates that there are approximately 27 million sole proprietorships. These are not “Reporting Companies” unless they are organized as LLCs or Corporations.

Get Started Free Now – Only pay once the report has been reviewed by an expert, has your final approval and is ready to submit. Our services are only $75 for the first filing and $50 for each additional entity with similar primary ownership.

Who is a Beneficial Owner?

Beneficial ownership is not simple under the Corporate Transparency Act. A Beneficial Owner is an individual who exercises substantial control over a Reporting Company or owns or controls 25% or more of the ownership interests of a Reporting Company.

The Reporting Company must identify and list all Beneficial Owners. There is no limit to the number of Beneficial Owners.

25% or more ownership interest

The first part of the definition of Beneficial Owner is an individual who owns or controls 25% or more of the ownership interests of a Reporting Company. This is the traditional definition of ownership. If you own 25% or more of a business, you are a Beneficial Owner.

For most small businesses, this ownership test is the only part of the definition that matters. If you own 25% or more of a business, you are a Beneficial Owner.

Small businesses often have a single “class” of ownership interests. For example, if you own 25% or more of the stock in a corporation, you are a Beneficial Owner. If you own 25% or more of a limited liability company membership interests, you are a Beneficial Owner.

Ownership can be complicated in several ways under the Corporate Transparency Act dragging more people into the class of beneficial owners.

Direct and indirect ownership

Ownership can be direct or indirect. Direct ownership is when you own an ownership interest in a business. Indirect ownership is when you own an ownership interest in a business that owns an ownership interest in another business.

For example, if you own 25% or more of the stock in a corporation, you are a Beneficial Owner. If you own 25% or more of the stock in a corporation that owns 25% or more of another corporation, you are a Beneficial Owner.

The chain of indirect ownership can be long. For example, if you own 25% or more of the stock in a corporation that owns 25% or more of another corporation that owns 25% or more of another corporation that owns 25% or more of another corporation, you are a Beneficial Owner.

Ownership interests

Ownership interests can be voting or non-voting. Voting interests are ownership interests that have the right to vote on the management of the business. Non-voting interests are ownership interests that do not have the right to vote on the management of the business.

[Any equity, stock, or voting rights] interest classified as stock or anything similar, regardless whether it confers voting power or voting rights, and even if the interest is transferable.4

There are several types of ownership interests according to FinCEN for CTA compliance.

Equity, stock, or voting rights

- equity, stock or similar instrument,

- pre-organization certificate or subscription,

- transferable share an equity security,

- voting trust certificate for an equity security,

- certificate of deposit for an equity security,

- an interest in a joint venture, or

- certificate of interest in a business trust.

Capital or profits interest

- any interest in the assets or profits of a limited liability company,

- LLC membership interest, or

- LLC unit.

Convertible instruments

- any instrument convertible into an equity, stock, or voting right, or

- any instrument convertible into a capital or profits interest, or

- any future on any convertible instrument, or

- any warrant or right to subscribe to or purchase, sell, or subscribe to a share or interest in an equity, stock, or voting right, or capital or profits interest, even if such warrant or right is a debt.

Options or privileges

Ownership interests also include options or privileges. This means that any put, call, straddle, or other option for equity, stock, or voting rights, or capital or profits interest, is an ownership interest.

There is an exception for an option that is created and held by other investors without the knowledge or involvement of the reporting company.

Catch-all ownership interests

Finally, there is a catch-all for any other interest in a business that confers the right to share in the profits or losses of the business. This means any instrument, contract, arrangement, or understanding that gives the holder an ownership interest in the business.

Get Started Free Now – Only pay once the report has been reviewed by an expert, has your final approval and is ready to submit. Our services are only $75 for the first filing and $50 for each additional entity with similar primary ownership.

Substantial control

The other part of the definition of Beneficial Owner is an individual who exercises substantial control over a Reporting Company. This is the non-traditional definition of ownership. A person who exerts substantial control over a business is a Beneficial Owner under the Corporate Transparency Act.

Substantial control is separate and apart from ownership. You can be a Beneficial Owner without owning any part of the business.

Someone has substantial control if any one of the following are true:

- the person is a senior officer,

- the person has authority to appoint or remove senior officers or a majority of directors of the Reporting Company, or

- the person is an “important decision-maker”, or

- the individual has any other form of substantial control over the Reporting Company.

This interpretation of substantial control is very broad.

Senior officer

A senior officer is an individual who has responsibility for the management and direction of the Reporting Company.

Examples of clear cases from FinCEN include the following individuals who are senior officers of a Reporting Company:

- Chief executive officer,

- President,

- Chief financial officer,

- Chief operating officer,

- General counsel (or corporate counsel), or

- Any other officer, no matter what the title, who performs similar functions.

It is important to note that the title of the individual is not primary factor. The function of the individual is the key. The function of the individual is to direct, determine, or have substantial influence over the business. For example, an “EVP of Corporate Development” might have substantial control if that person makes decisions about mergers and acquisitions.

Appointment or Removal Authority

An individual has authority to appoint or remove senior officers or a majority of directors if the individual has the power to appoint or remove senior officers or a majority of directors of the Reporting Company, either directly or indirectly.

Important decision-maker

An individual is an important decision-maker if the individual directs, determines, or has “substantial influence” over important decisions.

What is an important decision?

Important business decisions relate to strategy. Business decisions include questions about the nature and scope of the business. Strategic decision about entering or ending a line of business would count. The ability to choose a geographic territory, for the business is an example of an important business decision. Even the ability to enter or terminate, a contract is an important business decision, provided the contract is “significant” for the business.

Financial decisions are important if they concern the sale, lease, mortgage, or transfer of assets critical to the business. Financial decisions also include the purchase or sale of goods or services that are critical to the business. Compensation schemes and incentive plans are also important financial decisions.

Any structure decision about the business is important. This includes decisions about the legal structure of the business, such as reorganization, dissolution, or merger. Amendments to governance documents are also important structure decisions.

Catch-all substantial control

Like Ownership Interests, there is a catch-all for any other form of substantial control over the Reporting Company. This means any other form of control over the business. This is designed to capture governance or management schemes that FinCEN has not thought of yet or might evolve in the future.

All of these characteristics of substantial control are simply designed to prevent Reporting Companies and individuals from avoiding the filing requirement by using a different title or a different form of control.

What are the Exceptions to Beneficial Ownership?

FinCEN’s interpretation of Beneficial Ownership is sweeping. It is designed to capture as many individuals as possible. There are, however, several limited exceptions to Beneficial Ownership.

Minor child

Children do have to be listed as Beneficial Owners. Instead, the Reporting Company must list the parent or guardian of the minor child.

Once the child reaches the age of majority, the Reporting Company must file an update to the BOI Report to list the child as a Beneficial Owner.

Nominee, intermediary, custodian, or agent

If someone only acts on behalf of an actual beneficial owner as an agent, then the agent does not have to be listed as a Beneficial Owner.

This exception applies to individuals who provide services such as tax advice. Even if the exception applies, the underlying beneficial owner must still be listed.

Employee

At first glance, it seems like there is a conflict between officers (who are employees) of a company and the employee exception. The employee exception, however, only applies to employees who do not have substantial control over the business.

There are three requirements for the employee exception, all of which must be satisfied:

- the individual is an employee (there is a specific legal test for that status),

- the individual has substantial control over the business only because of the individual’s employment status, and

- the individual is not a senior officer (see Senior Officers).

Inheritor

Someone who will receive an ownership interest in the future does not have to be listed as a Beneficial Owner. This exception applies to someone who will receive an ownership interest in the future, such as a beneficiary of a will.

Once the person inherits the interest, however, the Reporting Company must file an update to the BOI Report to list the person as a Beneficial Owner.

Creditor

A person who is a creditor of a Reporting Company is not a Beneficial Owner. This exception applies to a person who has a security interest in the assets of the Reporting Company. This exception applies provided that the debt is the sole reason for the person’s interest in the Reporting Company.