Don’t delay – the Real Estate Business is one of the Most Affected Industries in terms of the number of entities/owners now required to Report. We can help offering expert advice and discounts for multiple reporting entities required to file.

Real Estate Professional – Contact us for multi entity discounts and referral program

- Directors and board members of rental properties

- Investment corporations

- Development corporations

- Rental property managers

- Investment property managers

- Development property managers

EBook Exclusively for Real estate Investors! 30 Pages of easy to understand Rules on the New FINCEN Mandate Only $9.99 – FREE TODAY!

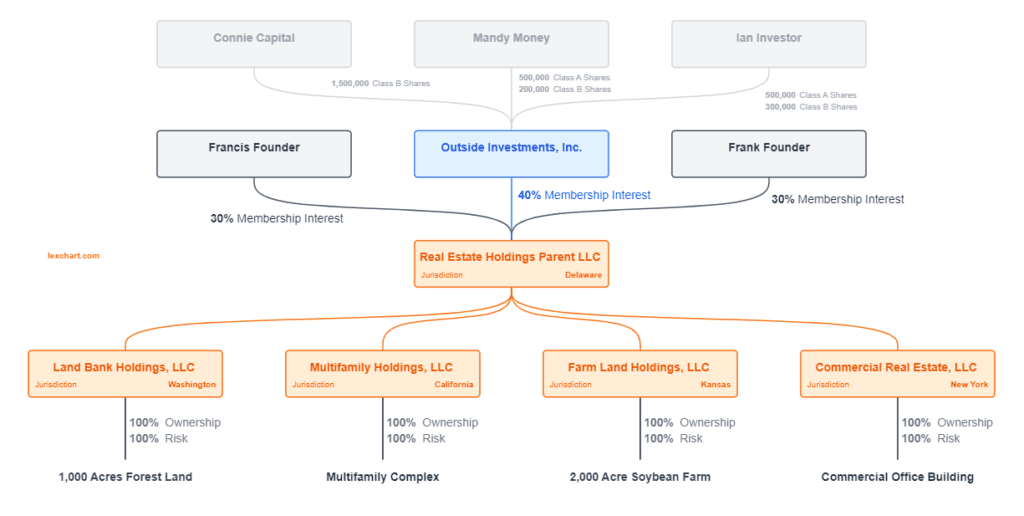

The Corporate Transparency Act’s Effect on Real Estate Transactions -The establishment of the Corporate Transparency Act’s (CTA) in the US denotes a huge change in the administrative scene, especially in the domain of land exchanges. The Act requires corporations and limited liability companies to disclose beneficial ownership information in order to combat financial crimes. This move has a direct impact on the real estate industry, which is typically a sector in which shell companies frequently play a significant role. This article dives into the ramifications of the CTA on land exchanges, looking at its possible impacts on obscurity, hostile to illegal tax avoidance measures, and the more extensive housing market.

Next Steps for Corporate Directors, Board Members, and Property Managers

Based on the Corporate Transparency Act’s current broad language, a property management company could be defined as having “substantial influence over important decisions,” and be subject to the Act’s requirement along with the corporate directors.

Accordingly, directors and board members of rental property, investment and development corporations, and in some cases, management companies, would need to provide the required personal information and documents to the U.S. Department of the Treasury.

Background: Shell Companies in Real Estate – For a long time, high-value real estate transactions in the United States have attracted nefarious funds, frequently through the assistance of shell companies. These elements, known for their murky proprietorship structures, have empowered people to secretly buy properties, in this way concealing their characters and the wellsprings of their assets. Regulators have been very concerned about this anonymity because it could lead to money laundering and other financial crimes.

The Corporate Transparency Act: A game-changer – The CTA ushers in a new era of corporate ownership transparency. It requires enterprises, LLCs, and comparative substances to unveil their valuable proprietors’ data to FinCEN. A gainful proprietor is characterized as any person who either practices significant command over the substance or claims no less than 25% of its possession advantages. The layers of anonymity that have long shrouded real estate transactions involving shell companies will likely be exposed by this requirement.

Impact on Real Estate Transaction Anonymity – The primary effect of the CTA on real estate transactions is the loss of anonymity. Purchasers who recently depended on shell organizations for security will currently confront expanded openness. Real estate investors may find it more difficult to conceal their identities as a result of this change, which has the potential to discourage illegal activities. Be that as it may, it likewise raises worries for genuine purchasers who look for protection in light of multiple factors, going from individual security to business secrecy.

Increasing Anti-Money Laundering Efforts – The CTA is likely to boost real estate anti-money laundering (AML) efforts. The Act makes it easier for authorities to locate illicit funds and take action against those involved in financial crimes by requiring disclosure of beneficial ownership. To understand and comply with the new regulations, real estate professionals, such as agents, brokers, and attorneys, will need to be more vigilant and may require additional training.

Challenges for the Real Estate Business – The execution of the CTA presents a few difficulties for the Real Estate business. Additional due diligence will be required for compliance, which could lengthen transaction times and raise costs. Real estate professionals will be required to navigate these new requirements in order to ensure that corporate entity transactions comply with the CTA. Besides, there may be a time of change as the business adjusts to these changes, with an expected starting lull in exchanges including corporate purchasers.

Impact on Foreign Investment – The U.S. housing market has forever been appealing to unfamiliar financial backers, a significant number of whom like to contribute through companies because of multiple factors, including security and responsibility insurance. The CTA could impact the choices of these financial backers, as some may be deflected by the expanded divulgence necessities. However, it may also increase investors’ faith in the market’s integrity, attracting those who value openness and legal compliance.

Data Management and Technological Solutions – It is likely that technological solutions will emerge in order to effectively manage the new reporting requirements. Land organizations might go to particular programming for following useful proprietorship data and guaranteeing consistence. Moreover, overseeing and safeguarding the delicate information gathered will be fundamental, given the security concerns and potential for information breaks.

Potential Legal and Ethical Issues – The CTA brings up a number of legal and ethical issues. There might be arguments about how to strike a balance between the right to privacy and the need for transparency. Moreover, the potential for abuse of proprietorship data, while possibly not enough shielded, represents a huge concern. Interpreting the Act and advising clients on compliance while upholding ethical standards will require the assistance of legal professionals.